What is investment Bank?

Investment banking is a specific division of banking related to the creation of capital for other companies, governments and other entities. Investment banks underwrite new debt and equity securities for all types of corporations, aid in the sale of securities, and help to facilitate mergers and acquisitions, reorganizations and broker trades for both institutions and private investors. Investment banks also provide guidance to issuers regarding the issue and placement of stock.

BREAKING DOWN 'Investment Banking '

Many large investment banks are affiliated with or subsidiaries of larger banking institutions, and many have become household names, the largest being Goldman Sachs, Morgan Stanley, JPMorgan Chase, Bank of America Merrill Lynch and Deutsche Bank. Broadly speaking, investment banks assist in large, complicated financial transactions. This may include advice as to how much a company is worth and how best to structure a deal if the investment banker’s client is considering an acquisition, merger or sale. It may also include the issuing of securities as a means of raising money for the client groups, and creating the documentation for the Securities and Exchange Commission necessary for a company to go public.

Investment banks employ investment bankers who help corporations, governments and other groups plan and manage large projects, saving their client time and money by identifying risks associated with the project before the client moves forward. In theory, investment bankers are experts in their field who have their finger on the pulse of the current investing climate, so businesses and institutions turn to investment banks for advice on how best to plan their development, as investment bankers can tailor their recommendations to the present state of economic affairs.

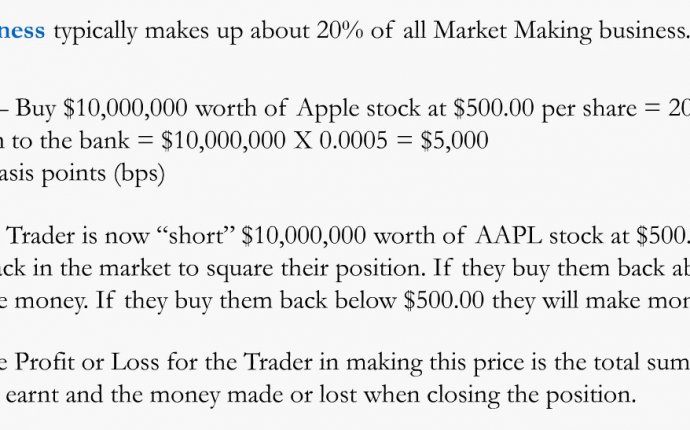

Essentially, investment banks serve as middlemen between a company and investors when the company wants to issue stock or bonds. The investment bank assists with pricing financial instruments so as to maximize revenue and with navigating regulatory requirements. Often, when a company holds its initial public offering (IPO), an investment bank will buy all or much of that company’s shares directly from the company. Subsequently, as a proxy for the company holding the IPO, the investment bank will sell the shares on the market. This makes things much easier for the company itself, as they effectively contract out the IPO to the investment bank. Moreover, the investment bank stands to make a profit, as it will generally price its shares at a markup from the price it initially paid. Yet, in doing so the investment bank also takes on a substantial amount of risk. Though experienced analysts at the investment bank use their expertise to accurately price the stock as best they can, the investment bank can lose money on the deal if it turns out they have overvalued the stock, as in this case they will often have to sell the stock for less than they initially paid for it.

For example, suppose that Pete’s Paints Co., a chain supplying paints and other hardware, wants to go public. Pete, the owner, gets in touch with Jose, an investment banker working for a larger investment banking firm. Pete and Jose strike a deal wherein Jose (on behalf of his firm) agrees to buy 100, 000 shares of Pete’s Paints for the company’s IPO at the price of $24 per share, a price at which the investment bank’s analysts arrived after careful consideration. The investment bank pays $2.4 million for the 100, 000 shares and, after filing the appropriate paperwork, begins selling the stock for $26 per share. Yet, the investment bank is unable to sell more than 20% of the shares at this price and is forced to reduce the price to $23 per share in order to sell the remaining shares. For the IPO deal with Pete’s Paints, then, the investment bank has made $2.36 million [(20, 000 x $26) + (80, 000 x $23) = $520, 000 + $1, 840, 000 = $2, 360, 000]. In other words, Jose’s firm has lost $40, 000 on the deal because it overvalued Pete’s Paints.

Investment banks will often compete with one another for securing IPO projects, which can force them to increase the price they are willing to pay to secure the deal with the company that is going public. If competition is particularly fierce, this lead to a substantial blow to the investment bank’s bottom line. Most often, however, there will be more than one investment bank underwriting securities in this way, rather than just one. While this means that each investment bank has less to gain, it also means that each one will have reduced risk.

keiser university blackboard university of scranton saint xavier university lexington management which of the following most accurately describes data lifecycle management (dlm)? university of washington seattle university medical center clemson university westcliff university new mexico state university samuel merritt university richmond university american intercontinental university university of central florida northwestern state university university of rhode island fayetteville state university marymount university clarke university southwestern university university of tampa bolivia university accident vanderbilt university medical center cash management william paterson university foundation property management west coast university student portal grantham university northeastern state university university of iowa metropolitan state university dallas baptist university university of hartford castleton university gardner webb university washington university west coast university student portal oklahoma state university east central university michigan state university seattle pacific university florida atlantic university northern arizona university brenau university liberty university football transylvania university university of tulsa averett university elizabeth city state university clarke university duquesne university gonzaga university southeastern oklahoma state university blackboard ohio university valparaiso university irvine, california university university of northern colorado irvine, california university wake forest university university of notre dame mississippi state university xavier university of louisiana kansas state university university federal credit union penn state university lehigh university jackson state university florida a&m university loyola university maryland fordham university sacred heart university northeastern illinois university rivier university reinhardt university adelphi university brandman university wayne state university phoenix university university of north carolina wilmington thomas edison state university worcester state university elon university east stroudsburg university eastern michigan university university of northern colorado university of hawaii at manoa saint joseph's university university of california riverside clark atlanta university husson university yonsei university university of toronto property management jobs northwestern state university meridian property management chamberlain university student portal southern university football university health system samford university colorado university