Trade cycle in investment Banking

Although every business cycle is different, our historical analysis suggests that the rhythm of cyclical fluctuations in the economy has tended to follow similar patterns. Moreover, performance across asset categories typically rotates in line with different phases of the business cycle. As a result, a business cycle approach to asset allocation can add value as part of an intermediate-term investment strategy.

Although every business cycle is different, our historical analysis suggests that the rhythm of cyclical fluctuations in the economy has tended to follow similar patterns. Moreover, performance across asset categories typically rotates in line with different phases of the business cycle. As a result, a business cycle approach to asset allocation can add value as part of an intermediate-term investment strategy.

Understanding the business cycle

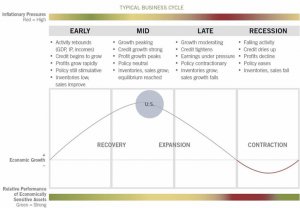

Every business cycle is different in its own way, but certain patterns have tended to repeat themselves over time. Fluctuations in the business cycle are essentially distinct changes in the rate of growth in economic activity, particularly changes in three key cycles—the corporate profit cycle, the credit cycle, and the inventory cycle—as well as changes in the employment backdrop and monetary policy. While unforeseen macroeconomic events or shocks can sometimes disrupt a trend, changes in these key indicators historically have provided a relatively reliable guide to recognizing the different phases of an economic cycle. Our quantitatively backed, probabilistic approach helps in identifying, with a reasonable degree of confidence, the state of the business cycle at different points in time. Specifically, there are four distinct phases of a typical business cycle (see chart, below):

- Early-cycle phase: Generally a sharp recovery from recession, marked by an inflection from negative to positive growth in economic activity (e.g., gross domestic product, industrial production), then an accelerating growth rate. Credit conditions stop tightening amid easy monetary policy, creating a healthy environment for rapid margin expansion and profit growth. Business inventories are low, while sales growth improves significantly.

- Mid-cycle phase: Typically the longest phase of the business cycle. The mid-cycle is characterized by a positive but more moderate rate of growth than that experienced during the early-cycle phase. Economic activity gathers momentum, credit growth becomes strong, and profitability is healthy against an accommodative—though increasingly neutral—monetary policy backdrop.

Inventories and sales grow, reaching equilibrium relative to each other.

Inventories and sales grow, reaching equilibrium relative to each other. - Late-cycle phase: Emblematic of an “overheated” economy poised to slip into recession and hindered by above-trend rates of inflation. Economic growth rates slow to “stall speed” against a backdrop of restrictive monetary policy, tightening credit availability, and deteriorating corporate profit margins. Inventories tend to build unexpectedly as sales growth declines.

- Recession phase: Features a contraction in economic activity. Corporate profits decline and credit is scarce for all economic factors. Monetary policy becomes more accommodative and inventories gradually fall despite low sales levels, setting up for the next recovery.

The business cycle has four distinct phases, with the example of the U.S. in a mid-cycle expansion in mid-2014.

Note: This is a hypothetical illustration of a typical business cycle. There is not always a chronological progression in this order, and there have been cycles when the economy has skipped a phase or retraced an earlier one. Economically sensitive assets include stocks and high-yield corporate bonds, while less economically sensitive assets include Treasury bonds and cash. Please see endnotes for a complete discussion. Source: Fidelity Investments (AART).

Note: This is a hypothetical illustration of a typical business cycle. There is not always a chronological progression in this order, and there have been cycles when the economy has skipped a phase or retraced an earlier one. Economically sensitive assets include stocks and high-yield corporate bonds, while less economically sensitive assets include Treasury bonds and cash. Please see endnotes for a complete discussion. Source: Fidelity Investments (AART).

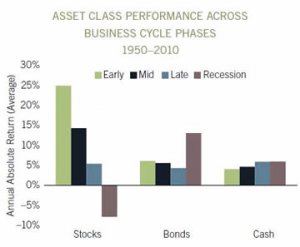

Historically, performance for stocks and bonds has been heavily influenced by the business cycle.

Past performance is no guarantee of future results. Asset class total returns are represented by indexes from the following sources: Fidelity Investments, Ibbotson Associates, Barclays, as of Jul. 31, 2014. Source: Fidelity Investments proprietary analysis of historical asset class performance, which is not indicative of future performance.

Looking at the performance of stocks, bonds, and cash from 1950 to 2010, we can see that shifts between business cycle phases create differentiation in asset price performance (see chart, right). In general, the performance of economically sensitive assets such as stocks tends to be the strongest when growth is rising at an accelerating rate during the early cycle, then moderates through the other phases until returns generally decline during recessions. By contrast, defensive assets such as investment-grade bonds and cash-like short-term debt have experienced the opposite pattern, with their highest returns during a recession and the weakest relative performance during the early cycle.

By contrast, defensive assets such as investment-grade bonds and cash-like short-term debt have experienced the opposite pattern, with their highest returns during a recession and the weakest relative performance during the early cycle.

Asset allocation decisions are rooted in relative asset class performance, and there is significant potential to enhance portfolio performance by tilting exposures to the major asset classes based on shifts in the business cycle. Investors can implement the business cycle approach to asset allocation by overweighting asset classes that tend to outperform during a given business cycle phase, while underweighting those asset classes that tend to underperform. In the early cycle, for example, the investor using this approach would overweight stocks and underweight bonds and cash.

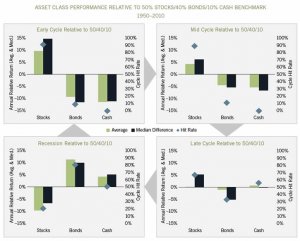

In the analysis that follows, we consider asset class performance patterns across the phases of the business cycle, both on an absolute basis and using several measures relative to a long-term strategic allocation to a balanced benchmark portfolio of 50% stocks, 40% bonds, and 10% cash (see “Analyzing relative asset class performance, ” below). Business cycles since 1950 are represented, and all data are annualized for comparison purposes.

Analyzing relative asset class performance

Certain metrics help us evaluate the historical performance of each asset class relative to the strategic allocation by revealing the potential magnitude of out- or underperformance during each phase, as well as the reliability of those historical performance patterns (see chart, below).

- Full-phase average performance: Calculates the (geometric) average performance of an asset class in a particular phase of the business cycle and subtracts the performance of the benchmark portfolio. This method better captures the impact of compounding and performance that is experienced across full market cycles (i.e., longer holding periods). However, performance outliers may skew results.

- Median monthly difference: For each month, calculates the difference in the performance for an asset class compared to the benchmark portfolio, and then takes the midpoint of those observations. This measure is indifferent to when a return period begins during a phase, which makes it a good measure for investors who may miss significant portions of each business cycle phase. This method mutes the extreme performance differences of outliers, and also underemphasizes the impact of compounding returns.

- Cycle hit rate: Calculates the frequency of an asset class outperforming the benchmark portfolio over each business cycle phase since 1950. This measure represents the consistency of asset class performance relative to the broader market over different cycles, removing the possibility that outsized gains during one period in history influence overall averages. This method suffers somewhat from small sample sizes, with only 10 full cycles during the period, but persistent out- or underperformance can still be observed.