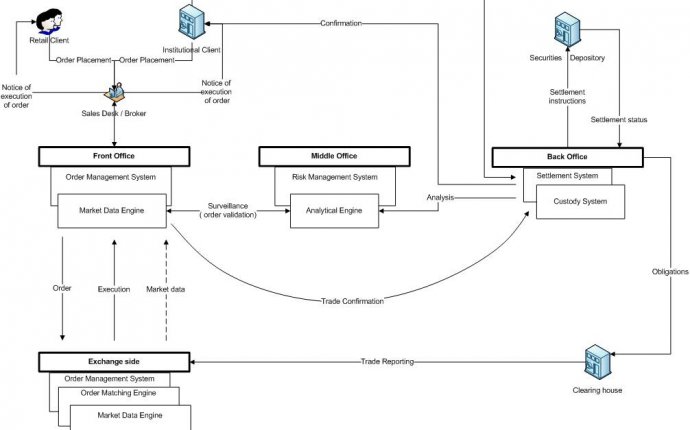

Trade life cycle Diagram investment Banking

Ever wondered how on Earth all the different components and stages of a trade fit together? There’s a well-oiled infrastructure machine that carries through the trade life cycle for literally trillions of trades – every day! Here’s an explanation of the key stages of the trade life cycle…

We start with our investors. An investor (either an individual who invests for themselves, known as a ‘retail investor’, or an institution, an organisation investing on behalf of their clients such as a fund) scopes out some tasty potential investment opportunities. Once they’ve made a decision to make a move and buy a particular security, such as shares in a company, the process kicks off…

Stage one: the order

The investor informs the broker firm and their custodian (a financial institution – usually a bank – which looks after their assets for safekeeping) of the security they would like to buy, and at what price – either the market price or lower. This is called a buy order.

(A couple more jargon nuggets for you here: A market order is an order to buy or sell at the market prices. A limit order is an order to buy or sell at a client’s specified price, or higher.)

Stage two: front office action

The investor’s order is received by the front office sales traders at the brokerage firm. From this point, the order is fed down to the risk management experts in the middle office of the organisation. The sales traders then ‘execute’ the order…

Stage three: risk management

The risk management team will conduct a number of checks and calculations to see whether the levels of risk involved with the client’s order mean it’s still safe to accept and proceed to the next stages. Amongst other things they will check the client placing the order has sufficient stocks to pay for the security and the limits.

Stage four: off to the exchange

When an order is accepted and validated by the risk management team, the broker firm sends it to the Stock Exchange…

Now, let’s pause for a breather and consider what’s going on the sell-side of things, i.e. the guys with the security to sell. They will also put in a sell order to their broker, stating the security they have to make available on the market and the market price (how much they want to sell it for).

The sell order goes through all of the necessary risk management procedures in the middle office on this side as well. All being well, it then shoots off to the exchange too…