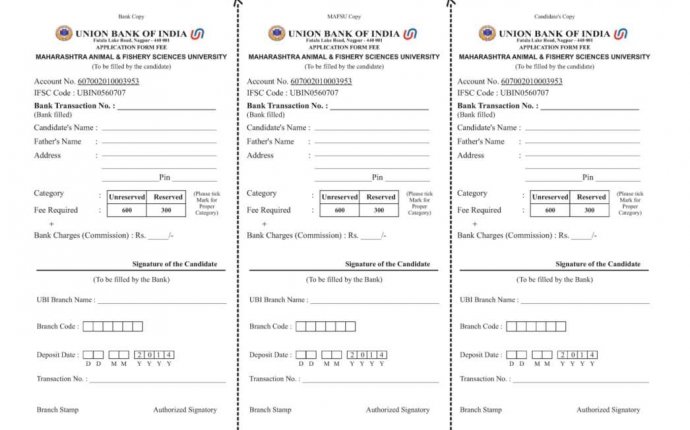

Union Bank of India Education Loan form

- Be an Indian National

- Has secured admission to professional or technical courses through an appropriate Entrance Test or selection process

- Has secured admission to a foreign University

- Has passed an appropriate qualifying examination

Courses

a) Studies in India

- School education up to +2

- Graduation/Post-Graduation

- Professional course

- Management course

- Special Education Loan Scheme for Students pursuing courses from approved institutions like IITs/ IIMs/ NIT / XLRI/ BITS/ VIT/ IISc/ S.P. Jain Institute Of Management/ Symbiosis Institute Of Management and T.S. Chanakya, Navi Mumbai- Nautical Science and MERI, Calcutta, Marine Engineering, MERI, Mumbai, Maritime Science.

a) Studies abroad

- Graduation: For job-oriented professional or technical courses offered by reputed universities

- Post-Graduation: MCA, MBA, MS and such other courses

- Courses conducted by CIMA, London, CPA, USA., and such other institution

Loan Details

Coverage of Expenses

- Hostel/Boarding Fees including caution deposit/building fund etc.

- Books, Stationery & Equipment required for the course, including Computers.

- Examination/Library/Laboratory fees.

- Travel Expenses/Passage for studies abroad.

Quantum

- Studies in India : Up to Rs. 10 lacs

- Studies Abroad : Up to Rs. 20 lacs

Margin

- Upto Rs. 4 Lac - Nil

- For loans above Rs. 4 lacs

- Studies in India - 5%

- Studies abroad - 15%

Service Charge : There is no processing fee /upfront /service charge

Scholarship/assistance to be included in margin.

Security

- Loans up to Rs. 7.50 lacs - No collateral security is needed

- For loans above Rs. 7.50 lacs - collateral security of suitable value, along with co-obligation of parents/ guardian/ third party, accompanied by an assignment of future income of the student for payment of installments is required.

For Male Student :

- For loans up to Rs. 4.00 lakhs - 11.75% (Fixed)

- For loans above Rs. 4.00 lakhs upto Rs.7.50 lakhs - 12.50% (Fixed)

- For loans Above Rs. 7.50 lakhs - 12.00% (Fixed)

For Female Student :

- For loans up to Rs. 4.00 lakhs - 11.25% (Fixed)

- For loans above Rs. 4.00 lakhs upto Rs.7.50 lakhs - 12.00% (Fixed)

- For loans Above Rs. 7.50 lakhs - 11.50% (Fixed)

Course period + 1 year OR 6 months after job placement, whichever is earlier.

Starting from this point, the loan is to be repaid in 5-7 years after completion of course period/moratorium.

Contact Details

Head Office

Union Bank of India,

239 Vidhan Bhavan Marg, Central Office,

Nariman Point, Mumbai -21