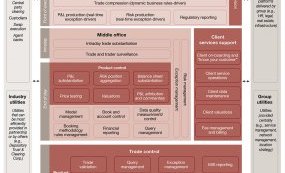

Investment Banking value chain

For this reason, through announcements of strategy, organizational, and leadership changes — most recently by the likes of Deutsche Bank, Credit Suisse, and Barclays, preceded by an earlier move at UBS — one question has framed the discussion for all global banks, at least in the minds of their audiences: What is their strategy for the investment bank?

For this reason, through announcements of strategy, organizational, and leadership changes — most recently by the likes of Deutsche Bank, Credit Suisse, and Barclays, preceded by an earlier move at UBS — one question has framed the discussion for all global banks, at least in the minds of their audiences: What is their strategy for the investment bank?

The answers from the banks are starting to go beyond the post-crisis patter of risk-weighted assets and cost reduction. For the past seven years, nearly all banking organizations have continued to take steps to de-risk, de-lever, refocus, simplify, and drive out cost. But now they are also starting to look at more fundamental transformations.

For the past seven years, nearly all banking organizations have continued to take steps to de-risk, de-lever, refocus, simplify, and drive out cost. But now they are also starting to look at more fundamental transformations.

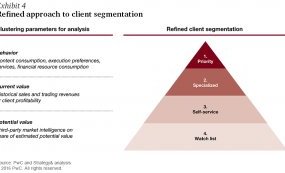

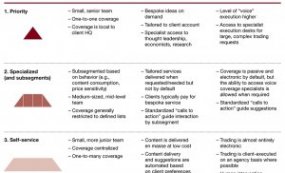

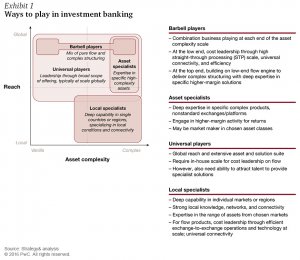

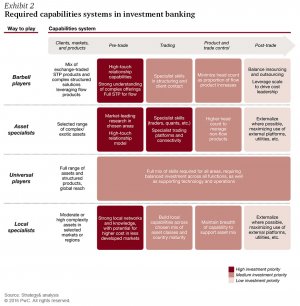

Some have chosen to pare their investment banking businesses back to the bare minimum needed to service the private, corporate, and institutional clients on which their core franchises depend.

Others — including those for whom investment banking essentially is their core franchise — see more of a future for investment banking in its own right. These banks are concentrating on the product, service, operational, customer, and regional niches where they believe they can win in the medium to longer term.

Those still committed to a universal banking model that offers a full range of products and services are looking to offer something that their more specialized peers cannot: a combination of best-in-class advice, global multi-asset execution capability, and aggressive pricing, all underpinned by technology and scale efficiency.

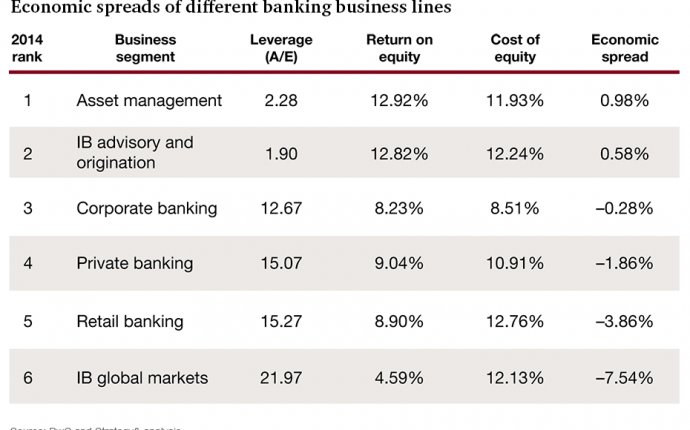

The regulatory demand for higher levels of capital continues to be both a focal point and a general concern of the sector, and is a particular handicap for certain investment banking product and service categories. However, there is an emerging dichotomy between, on one hand, the continued focus on capital efficiency and, on the other, a willingness to deliver strategies based on an unquestionably strong balance sheet. As Tidjane Thiam, CEO of Credit Suisse, has put it, “The penalty for having too much capital today is limited; the penalty for having too little [capital] in the banking sector is very material.”

In light of this, the capital efficiency agenda is less about maximizing return on equity through leverage — that game is up — and more about creating the balance sheet capacity, in combination with fresh capital issuance when necessary, to grow in areas where sustained economic profits can be made.