Investment Banking industry Overview

Companies in this industry underwrite, originate and maintain markets for clients issuing securities; they may also offer advisory services, help facilitate corporate mergers and other deals, or act as principals in buying or selling securities on a spread. Major companies include Goldman Sachs, Merrill Lynch, and Morgan Stanley (all based in the US), as well as Barclays (UK), Deutsche Bank (Germany), Macquarie Group (Australia), Nomura (Japan), and Credit Suisse (Switzerland).

Competitive Landscape

Demand is driven by economic activity that results in company mergers, acquisitions, or public financing. The profitability of an investment bank depends on its ability to accurately assess both the value of a business transaction and the readiness of the market to buy the attendant debt or equity. Big firms have an advantage because large customer transactions require firms with substantial financial and technological resources and global networks. Small investment banks can compete by participating in syndications and operating in regional markets or specialized industries. The US industry is highly concentrated: the eight largest firms generate about two-thirds of industry revenue.

Products, Operations & Technology

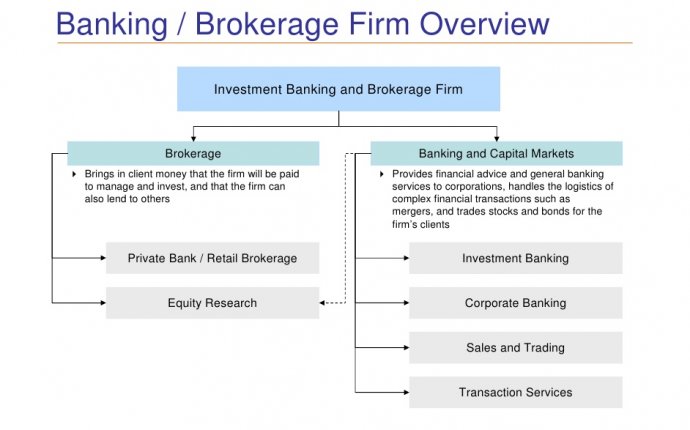

The primary revenue sources of the investment banking industry are from actively trading financial instruments, providing asset management services for wealthy clients and retirement and investment funds, placing new debt and equity issues with public and private investors, and from fees associated with mergers and acquisitions (M&As). Investment banks also buy new debt and equity issues for their own accounts, acting as the market "maker, " and are active securities and currency traders. About 45% of US industry revenue comes from brokerage and securities services; 30% from trading; and 25% from financial planning and asset management.