Investment Banking VS consulting

By Fiona Tang, WH MBA ’17 and Wharton Graduate Assistant

Investment Banking vs. Consulting – A Student Perspective

By: Fiona Tang

Investment banking and consulting are usually popular career choices after graduation because of their great training programs, brand names and wide range of exit opportunities. Having been fortunate enough to work at both McKinsey and Goldman Sachs, I would like to share some pros and cons of each industry from my perspective.

Compensation: Banking tends to be more lucrative

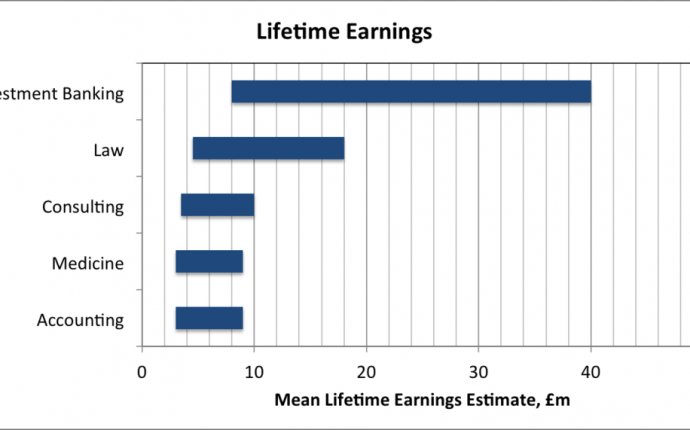

Base salaries are similar in banking and consulting, but the bonus varies significantly for each industry. In banking, the bonus received may be valued as much as 12 or 24 months of your base salary while in consulting the maximum bonus is probably 6 months of salary. There is generally a 20% – 40% pay difference between banking and consulting at all position levels. Exit opportunities are also more lucrative after banking positions compared to consulting roles. Private equity and investment management positions pay a lot more than strategy roles in big corporations. If compensation is an important role in your decision making, banking might be a better option.

Job Security: Consulting is more secure

Job security in consulting is much less cyclical than banking. Regardless of good economic times or bad economic times, consulting firms continue hiring and minimize layoffs of junior staff. Investment banks, on the other hand, layoff more workers and enact hiring freezes during financial downturns. For example, this summer after I left Goldman Sachs, the Hong Kong office laid off 20 analysts and associates because the market isn’t doing well now.

Work Lifestyle: Unpredictable hours vs. Traveling

If you are looking for a 40 hour per week job, neither consulting or banking is ideal for you. The hours are LONG, generally 70-100 hours per week depending on your project or deal. As you become more senior and gain more work experience, the hours can be shorter. But my manager at McKinsey and VP at Goldman both still send emails to their teams at 2am on occasion – the nature of the work illustrates banking and consulting will never be nine-to-five jobs.

The big difference is that consulting is intense during the week but in general doesn’t require you to work on the weekends. The hours are more predictable as you will be working on one specific project and it’s easier to manage and plan ahead. The downside to consulting is endless traveling from Monday to Thursday. Trust me, waking up at 5am to catch a 7am flight to the client site on Monday is not fun.

Banking requires much less travel at junior level. However, the hours are less predictable as you don’t know when a deal will intensify or a pitch suddenly becomes live. As an analyst, you will be staffed on multiple deals and it’s difficult to predict your work hours or make plans in advance. During a live deal, working on the weekends is considered pretty normal.

Daily Work: PowerPoint or Excel?

Both bankers and consultants spend the majority of their time on Excel and PowerPoint. The key difference in banking is a focus on finance specifically and financial modeling in general. Junior bankers devote their time to studying the value of a company and its capital structure; junior consultants think about the strategy of a company and its organizational structure.

The life of a consultant is interesting because of the broad range of projects managed by a range of different partners. Every project and every client is different and the learning curve is quite steep in the first couple of years. However, sometimes I do struggle with limited opportunities to put ideas into practice – like junior bankers who put together endless pitch books for M&A deals that never happen.