What is Middle office in investment Banking?

Do you really need to work in the front office of an investment bank? What if you’re….in the back?

Are some jobs in banks really much better than others?

If you’re thinking of applying for a graduate job in an investment bank, you’ve probably come across the terms, ‘front office’, ‘middle office’ and ‘back office’ as descriptors for the kinds of jobs banks have to offer. You may even have heard ‘back office’ jobs referred to pejoratively. Should you care?

What’s the front office in an investment bank?

Front office investment banking jobs are usually the easiest to define. “Front office jobs in investment banks are those that are client facing, ” says John Craven, a former director of structured products and capital markets at Bank of America Merrill Lynch. “Areas where you’re directly facing clients, or creating products for clients, or trading.”

Chris Roebuck, a professor at London’s Cass Business School and former global head of transformational leadership at UBS, agrees that front office jobs are any that involve, “direct interaction with the client and customer – be that an individual or a corporate client.”

Equally confusingly, banks now employ people to do things like ‘XVA trading’, which means placing trades to offset various risks born by the bank as a whole. XVA trading desks don’t deal with clients, but can be interesting places to work. Are they front office? Seemingly not.

What’s the middle office in an investment bank?

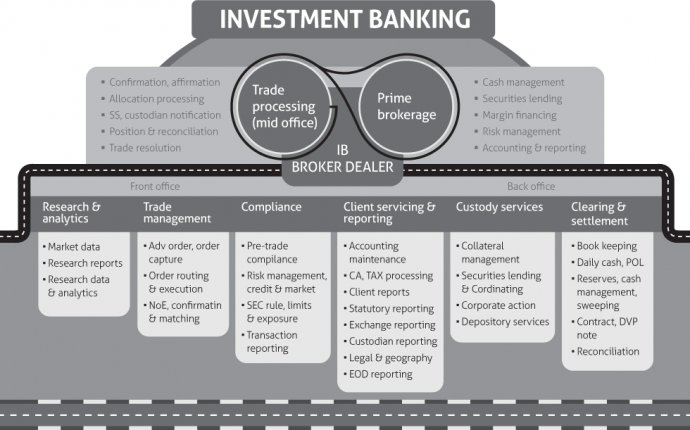

As per its name, the middle office of an investment bank is situated in the middle: somewhere between the front office and the back office.

“The middle office is all the people in the business divisions that directly support the front office, ” says Roebuck. “They’re directly supporting the people who are interfacing with clients.”

Be warned, however, that not all risk, compliance and technology jobs in banks are in the middle office. If they’re situated miles away from the trading floor and front office people and don’t involve any real interaction with traders, M&A bankers, or salespeople, they probably fall into the back office category.

“It’s perfectly possible for a risk person to be either in the middle office or the back office, ” says Roebuck. “You might get a risk professional sitting on the trading floor, in which case he or she would be a middle office person. And then you might get a risk person miles away in the corporate centre, in which case they’d be in the back office.”

Chris Wheeler, banking analyst at Atlantic Equities in London, points out that people in the middle office have risen in stature as banks stop focusing on making revenues at all costs and start thinking about the risks they’re taking to earn those revenues. “In a complex transaction, the middle office will come in and help structure the trade. They’ll also work to ensure that procedures are in place to allow the trade to be settled.”

What’s the back office in an investment bank?

The back office in an investment bank refers to all the functions that are behind the scenes. Back office professionals work in settlements, making sure that payments are processed. They work in human resources, making sure bankers get paid, or hired, or fired. They work in technology, making sure that central systems are running correctly. They can also work in areas like central compliance, monitoring employees’ conversations and making sure they’re not trading forbidden securities on their own accounts.

Back office jobs in investment banks can be considered uninteresting and undesirable. There’s a reason for this. “I worked in trade support covering settlements for a French bank in London, ” says one operations analyst. “It was all very static and process driven – I spent all day analyzing exception queues from various systems and analyzing trades to make sure they were settled properly. It was a repetitive job with very slow career progression.”

The good news, however, is that as banks automate systems and look for ways of saving money, technology jobs in investment banks are far more important than they used to be. – And that tedious operations jobs are increasingly being automated.

The other thing to note is that it’s not cool to talk about the front, middle and back office any more. Goldman Sachs, for example, has renamed all the functions in its middle and back office “The Federation.”

“The front, middle and back office are a dated concept, and if you’re thinking in those terms you work for a bank with cultural issues, ” says Roebuck. “Nowadays, you’re all in it together to drive performance.”