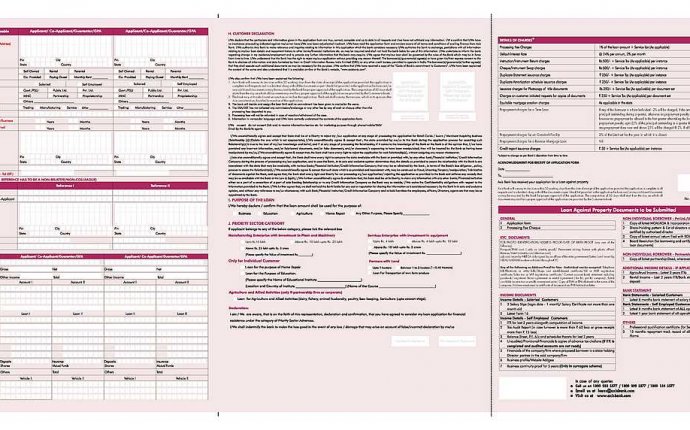

Bank of Baroda Education Loan interest rate

|

Courses Eligible : |

|||||||||||||

|

Student Eligibility :

|

|||||||||||||

|

Coverage of expenses :

|

|||||||||||||

|

Quantum of finance :

|

|||||||||||||

|

Margin : |

|||||||||||||

|

Rate of Interest : (CLICK HERE FOR CURRENT INTEREST RATES)

|

|||||||||||||

|

Moratorium period :

|

|||||||||||||

|

Repayment Period :

|

|||||||||||||

Source: www.bankofbaroda.com